Wednesday, June 27, 2007

"It's the Most Wonderful Time of the Year!"

Actually, this time of year makes it a great time to go through your W-4's and make sure you're having the right amount deducted. In fact, this is what I did last year (not only because of the pay raise, but also because of getting married) and I will do it again this year. This year I will have to increase the amount that is withheld from my paycheck. Since the first part of last year I was single, the amount that was withheld was quite a lot higher than it needed to be, so I changed the allowances in my W-4 so that I underpaid on the last half of the year. All told, by adjusting the withholding, I netted a measly $200 refund from the government (which made me ecstatic - no free loans to the government)! This year though, it meant that the first half of the year I have been slightly underpaying my predicted taxes - so that's where at least a portion of my raise is going to be siphoned off to.

Here's my process: First, I use MSN's tax estimator. This is pretty easy since I have quite predictable income and for the most part expenses. Then I take the difference between what I've already paid (should be on your pay stub) and what the estimator says I will owe, and divide that by the number of pay periods left in the year. This is what I fill out in the "Additional Withholding" when I submit my W-4. Just as a note, you are allowed to change the W-4 as often as you need to in order to have the right amount taken out of your paycheck. This system ensures that I don't pay Uncle Sam any more than I have to interest free.

Some people are so bold as to claim enough withholding allowances to not have to have income taxes witheld for 10 months out of the year, and then have the full amount withheld from the last two months. This would effectively allow them to bank the amount normally withheld for several months gaining interest. For example, if a person had an estimated tax bill of $4800, and instead of having $400 witheld from his paycheck every month, deposited it in an account bearing 5.00% APY for 10 months, and then had $2400 taken out of his paycheck the last two months, he would net about $103 from interest. This is an intruiging idea, but seems a little too close for comfort for just $100 or so (depending on your actual tax bill).

Tuesday, June 26, 2007

The Carnivals Are Up!

RetireYoungandWealthy is hosting the 15th Carnival of Money Stories with a great variety of posts on all aspects of personal finance. You can find the article submitted by your's truly here.

TheDigeratiLife put together the Carnival of Personal Finance: Epic Journey Edition with a nod to Homer's Odyssey. With 91 different articles, it may take as long as Ulysses' journey to read them all, but its a great collection of topics. Great job! My article was a brief one on Obopay.

Well that's all on the carnivals. Hopefully I'll be able to submit more in the future - maybe I'll even host one!

Monday, June 25, 2007

Lesson 8: Spending More to Buy Nicer Things

Being married means that I spend more on nicer things than I would have otherwise. Case in point: The two pictures show the relative differene in my perception of a "dream house" at this point in our lives. The first one is offered for a grand total of $7000, the second, for something like 2.1 mil. While I somewhat jest at the extent of our differences (who wouldn't want house #2?), the fact of the matter remains that as a single individual, I would probably have no problem living in a $7000 hovel.

Being married means that I spend more on nicer things than I would have otherwise. Case in point: The two pictures show the relative differene in my perception of a "dream house" at this point in our lives. The first one is offered for a grand total of $7000, the second, for something like 2.1 mil. While I somewhat jest at the extent of our differences (who wouldn't want house #2?), the fact of the matter remains that as a single individual, I would probably have no problem living in a $7000 hovel.  (In some ways, the contrarian glamor of it is rather appealing). Nevertheless, I wouldn't ever want my wife to have to live in a roach infested shack. (See Lesson 9: Living a happier, healthier life). Before I got married, I slept on a $50 futon, which was great for me, but I deemed unacceptable for married folk. We went out and got curtains and rods for the windows (which were perfectly fine bare).

(In some ways, the contrarian glamor of it is rather appealing). Nevertheless, I wouldn't ever want my wife to have to live in a roach infested shack. (See Lesson 9: Living a happier, healthier life). Before I got married, I slept on a $50 futon, which was great for me, but I deemed unacceptable for married folk. We went out and got curtains and rods for the windows (which were perfectly fine bare).But the real difference is the attitude of buying - not for an immediate need - but for something that is going to last. As opposed to buying furniture made of particle board that will disintigrate at the first sign of moisture, I've bought furniture that hopefully will last for years. Instead of buying tools for a project based on "what's the least expensive", I've bought tools that will last a lifetime (or at least have a guarantee for that long).

Many people buy for "now". They want the DVD/VCR combo, so they buy the Cheap-mart version for $50, as opposed to spending $90 for a version that will last more than twice as long (prices quoted are fictitious with no knowledge of actual prices). Such tradeoffs on price and quality are often difficult to quantify, but can be key to saving big bucks in the future. The way I was raised, if something is worth getting, its worth spending the extra time and asking the extra questions to make sure you're getting the best value. This really is the key, whether you are buying an air mattress, or a house. Having the right information allows you to make a good decision on the tradeoffs between price and quality - sometimes there isn't any difference, sometimes 5-10 dollars can make a big deal. So sure, I do spend more on things now that I'm married. But I'm confident that the extra money I spend has bought me quality, functionality, and value that more than makes up for the dollars of extra price.

Friday, June 22, 2007

The Economics of a High School Student

But my family was a little different. I didn't ever have a "real" summer job. Neither did my brothers. Nor did they really want me to get a summer job - even if I had one, I probably would have worked at my dad's business as an electric motor repairman - I'm sure I'll talk more about that in the future.

Why wouldn't my frugal, money-saving parents not encourage their high school students to get jobs? The reason is that we were involved in projects and competitions and community service through church and school that they felt were better uses for our time. In their view, school, and the extra-curricular activities along with it, were my "job". For example, in the summer of my junior year, I worked on a Science fair project that I spent over 200 hrs on. A couple of summers I helped out with my church's VBS camp with over 300 little kids. During the school year, I was involved in competitions from Social Studies fairs to Bible quizzing. Other than the benefits personally, when it came time to apply for colleges and scholarships, I had a resume full of academic and community activities - and folks like to give scholarships to students with full resumes.

So as opposed to a couple of summer jobs that I might have made 3000 or 4000 dollars each, I got scholarships worth $40,000, and $70,000 in addition to a number of other smaller scholarships. It's hard to beat "making" that kind of money for a high school student.

LazymanandMoney had a post with 15 things he would tell himself when he was back in high school. You should check it out!

Thursday, June 21, 2007

Obopay: The new way to send money

Wednesday, June 20, 2007

Lesson 9: A Healthier, Happier Lifestyle

Its proven: Married people live longer! Numerous studies have shown that there are a lot of benefits to one's overall well being and quality of life. While there may not be a direct quantifiable financial benefit, there are definitely improvements to everyone's productivity when they are happier and healthier. Overall, there is probably a slight (at least initial) cost to healthier living - more on this tomorrow. But the improvement in well-being is something that money can't buy, nor something that should have a price associated with it. Maybe in a strict dollars and cents calculations you'd come out a little ahead, maybe a little behind - in the end, who cares?

I've seen a number of posts elsewhere where people question whether financially it makes sense to get married. I would say that the question really misses the point of marriage in the first place. Saving, discussing and planning should be part of the marriage, but shouldn't be the reason for it. I'm thankful that in getting married, I have a life partner that I can share the rest of my life with. That is worth more to me than all the money in the world.

Tuesday, June 19, 2007

Lesson 10: Travel Costs are Less

However, what I want to talk about is making the decision to fly rather than drive. AAA has a calculator that shows the fuel cost for a given trip, but it's pretty simplistic in my opinion. Although the decision can be boiled down to just the cost of gas vs the cost of a ticket, there really is a lot more to try to model into the equation -some of which is difficult to quantify.

For instance, trying to go from Indiana to West Virginia was close to 6 hours of driving. A direct flight could have been only an hour and a half or less, but there aren't any direct flights, and there aren't really any major airports within an hour of either end of the destination. Adding up the total time would have been just about 5-6 hours - not significantly different than the driving time.

There are other costs to flying too - do you have to get a rental car once you are there? Are you carrying more than one passenger? But the decision isn't all weighted in favor of driving - there is additional wear and tear on the vehicle, (arguably) more stress, and the consideration of emissions (if that's your thing).

For major venues that are more than 5 hours away, are only one traveller, and don't need a rental car, flying often is the cheapest way to go. Over Christmas, I was able to get my wife a ticket for back home 10hrs away by car for just under $100. For other situations, especially when there is more than one person travelling, taking the car is usually the cheapest method.

I was highly disappointed that I wasn't able to find a halfway decent comparison calculator that would be able to show the driving time + cost as well as a flying time + cost based on starting/ending points, whether you needed a rental, and number of travellers. I guess I'll have to leave it up to someone else to develop it!

Monday, June 18, 2007

10 Lessons Learned from a Year of Marriage

2) Marriage will not solve money problems - keys to successful money management work whether you are married or not

3) But some of the best memories are from doing activities that require little to no money

4) Its important to talk about financial goals and expectations

5) But FAFSA rules are against getting married

6) Taxes are a lot less

7) But you also spend less in total on housing, food, utilities, etc.

8) You also spend more than you would have to buy nicer things

9) As a male, you take a lot better care of yourself than when you were single

10) You spend a lot less on gas to go visit your fiancee six hours away

Over the next couple of days, I hope to talk about each one of these lessons - so be sure to tune back in!

1st Anniversary! Marriage, and Finances

For our honeymoon, my wife and I went on a cruise to Alaska. Fortunately, we were able to avoid these mishaps:

http://www.foxnews.com/story/0,2933,272033,00.html

http://www.nbc6.net/news/13431946/detail.html?rss=ami&psp=news

http://www.cruisejunkie.com/Overboard.html

Over this past year, my wife also worked toward receiving her drivers license. Another close call for me!

http://blogs.kansascity.com/crime_scene/2006/08/mom_killed_by_t.html

I love my dear wife - and she is one of the best cooks I know. But somehow, she managed to pack spinach in my lunch the day after this story broke....

http://www.fda.gov/bbs/topics/NEWS/2007/NEW01593.html

I've also noticed that just general work around the house can be dangerous to your health

http://wcco.com/topstories/local_story_062193013.html

Also, I have managed to remain (relatively) unscathed from any major lovers quarrels.

http://www.ananova.com/news/story/sm_2261940.html?menu=news.quirkies

So all in all, I would say that I've had a great year!

Thursday, June 14, 2007

Do It Yourself!

Wednesday, June 13, 2007

Asset Allocation - June 2007

I thought I would post on my current asset allocation. This view is really just an overall high level view, since I have chosen not to split out between my 401(k), pension and non-retirement accounts. In addition, some of my non-retirement funds are held directly with the mutual fund, as opposed to dealing with a brokerage (such as Zecco and Scottrade). One thing that makes things a little confusing is the fact that because I have different accounts (401k, non retirement etc), I have more funds than I really would like to have. For example, I currently have 2 foreign funds + my emerging market fund. This is because the offerings in my 401(k) aren't necessarily what I would pick. This is why I haven't provided more detail on the individual funds I own yet. I know there are options to request your company to let you have a self-directed 401(k) and that can be a topic of later discussion, but I really haven't had time to look into it yet.

I thought I would post on my current asset allocation. This view is really just an overall high level view, since I have chosen not to split out between my 401(k), pension and non-retirement accounts. In addition, some of my non-retirement funds are held directly with the mutual fund, as opposed to dealing with a brokerage (such as Zecco and Scottrade). One thing that makes things a little confusing is the fact that because I have different accounts (401k, non retirement etc), I have more funds than I really would like to have. For example, I currently have 2 foreign funds + my emerging market fund. This is because the offerings in my 401(k) aren't necessarily what I would pick. This is why I haven't provided more detail on the individual funds I own yet. I know there are options to request your company to let you have a self-directed 401(k) and that can be a topic of later discussion, but I really haven't had time to look into it yet. Currently, it looks I have about 24% parked in stable value/bonds with the balance in various stock holdings. Actually, the percentage would probably be skewed more to stocks, except that I have included my company's pension balance in the stable value category, since the interest paid on it is pegged to the 10-year T-bill rate as of last September. Other than that, I think things are pretty straightforward. Of the stock mix, I have an approximately 40/60 split between US and foreign equities. While it may be somewhat chasing the hot idea, I feel that a significant exposure to foreign stocks will give me good returns, while being less risky than chasing sector performance. What do you think?

Tuesday, June 12, 2007

Money Saving Tips: Eliminate Baggage from your life

On Sunday, I talked about the "Ancient" Portfolio theory and how important it was to look at the choices you are making and determine to life simply and not strive for luxury you can't afford. This is my biggest money saving tip (perhaps its a philosophy really): Eliminate baggage from your life.

Here at Smiths Trading Post, my goal is to help people figure out the habits that they need to pick up, and the items in their life that need jettisoned. Let me explain. By eliminating or significantly reducing vices in our life, whether that be alcohol, cigarrettes, or an addiction to Starbucks lattes. MSN had an article on vices awhile back that itemized the costs of some of these, and revealed that they can reach in the thousands of dollars. A $2.50 latte every workday may not seem like a lot, winds up being over $500 in a year. Maybe you'll decide that you don't really need cable television - perhaps you can save $300 a year. Perhaps you'll eat home one more time at home in a week - for a couple of two at $20 a meal, that would save you almost $1000.

Essentially, taking stock in this way forces us to evaluate our conceptions of what give us meaning - do I have to have cable in order to be happy? Will I really feel deprived if I buy a used car rather than a brand new one?

Just as the pioneers had to forge a new path for themselves, we are blazing the trail for our financial future. An just as they had to leave much of their former life behind, we have to leave much of our (hidden) passion for luxury on the side of the road. I'm not necessarily advocating a strict Spartan existence, but I do think most of us (me included) could take a rather critical view our lives and can find items that are holding us back from achieving the the goals we have set for ourselves.

Monday, June 11, 2007

Quick List of current savings rates

$1 to open.

HSBC: 5.05% APY

HSBC: 5.05% APY$1 to open

Why I'm not moving to Zecco (Yet)!

I, however, am going to continue with my Scottrade account (for now). For a longterm investor, if you only have a couple of hundred bucks, $0 commissions certainly seems like it would be tempting. However, in the end, I think the more important lever would be making sure you pick good investments that you are willing to hold for more than a year - moving from paying taxes on short term capital gains to long term capital gains.

Example: For a $1000 investment gaining 20% in the 25% tax bracket, you'd save $20 (more than the $14 ($7 commission both ways) to Scottrade) just by holding on to your investment for a year rather than less than a year. If you think that you're burning up good ideas by not having a high turnover ratio, more power to you - and the thought is tempting - but it seems that Zecco is catering to more of a trading mentality rather than an investing mindset.

Keep in mind, also, that Scottrade allows you to buy and sell (most) no load funds for $0 commissions as well - I bought my emerging markets fund that way. $0 commissions on stock trades (effectively eliminating a 1.4% expense ratio on the example above) is rather tempting. Nonetheless, customer service and reputation are invaluable in the securities market, and the $7 commission seems like a small price to pay - although in time I think the playing field will level. Meanwhile, I'm going to stick with Scottrade for awhile while Zecco becomes established and works out some of their initial customer service issues.

Sunday, June 10, 2007

"Ancient" Portfolio Theory

Thursday, June 7, 2007

G-8 OKs ‘substantial cuts’ in warming gases

I'm all for responsible management of the environment, but it doesn't seem that trusting our own government, let alone an international government will be able to determine what the "best" way to legislate any sort of reduction to green house emissions. If this doesn't seem like a financial post, bear with me. In the end, setting limits on emissions and implenting caps and credit systems creates an additional tradeable commodity on top of the existing market. That is to say, government is artificially creating "markets" where previously there were none, and the costs of playing in these markets will wind up being passed on to consumers. In Europe, misallocation of credits, favoritism, lobbying etc have created a system where some of the worst offenders have extra credits, and some of the industries that have made the most investment into improving still have to purchase additional credits.

Ironically, the costs of doing business have made it impossible for many businesses to compete with foreign products, even though they are the most efficient in the world. Not only that, but businesses have often taken the "market value" total credits alloted and passed those costs to consumers, rather than only passing the costs of credits needed above their alloted amounts. In some places in Europe, electricity has almost tripled. I'm not saying that we shouldn't do what we can to protect the environment, but it seems that the forces for change should come from individuals and innovation which will save us in the long run, rather than artificial means by more restrictive government.

Defining Investing Terms - What is an Annuity?

One thing that I've noticed from people is that many don't know some of the basic terms of investing - such as how does a mutual fund work? What are short term and long term capital gains? What is a JTWROS? (ok maybe that isn't a common one) etc. Well, here on the Trading Post I will try to break down, define and analyze some of these seemingly complex money ideas. I hope this will be useful to everyone.

Annuity

What is an annuity? An annuity is a way to turn a present amount money into a specific number of future payments. To put it simply, if you give me $1000, and I promised you $100 for ten years, that would be an annuity. However, the present value of money is worth more than promised future streams of money, so in reality, you would want me to promise to give you perhaps an annuity of $110.

Pensions are really a form of an annuity, and mortgages are really (in a simplistic sense) the opposite of an annuity. Annuities can also be structured to change too - such as, for example above, $50 the first year, $75 the second year $150 the third year, $125 the fourth year and so on. This could be tied to various measures, such as how well the stock market is doing, or the profitability of a business. Insurance companies also provide a huge assortment of annuity products which can sometimes seem overwhelming. If all the criteria was the same, such as a guaranteed annuity for 20 years fixed, then it would be easy to choose - you would just pick the annuity that was highest (it would be giving you the highest effective rate of return) But there are all sorts of twists, such as continuing for only as long as the annuitant lives, or one that would continue to pay out to a spouse. The length of time can be different too. These all can make it very difficult to compare - and turns what at first appear a financial decision into one very much dependent on ones subjective tolerance to risk.

Excel and other spreadsheets and financial tools have functions that will tell you the equivalent interest rate for a specified present value and annuity value.

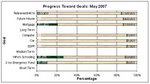

Goals

Wednesday, June 6, 2007

Deer in the Headlights

For insurance, I find that a remarkable number of people really don't know much about their coverage, and can't really tell you what's a lot, a little or appropriate. Of course, an insurance salesman would be sure to tell you that you can't ever have too much insurance, but frankly, what else would they tell you? To be honest, I'm not sure that I know a lot about insurance, but I'll share my philosophy about it.

Of course it may seem obtuse to say that insurance is all about risk. But it really is, and figuring out the risk requires a reasonable knowledge of your financial situation. Without a clear understanding of your own finances, you really have very little way to calculate what your true risk is in a given set of circumstances. Secondly there's a very big difference between financial pain, and financial disaster - totaling my 1995 Saturn would be financial pain - I'd hate to have to pay $2000 to try to find another old clunker. Losing my house, that would be disaster. Similarly for medical bills - breaking an arm and paying $1500 would hurt, having a heart attack and paying $90000 would be disasterous. Obviously if you are really tight from paycheck to paycheck, you may be in the situation that even a small event could mean financial disaster, but obviously don't have the money to spare to eliminate the chance of disaster with "bulletproof" insurance. In this case most people are forced to take their chances with increased risk of financial disaster

This all plays into my decisions in choosing my coverage. For my auto insurance, I have a $100,000/$300000/$100000 coverage, but no collision coverage on my clunkers. For my house, I have a $1000 deductible. I would have chosen something around $5000-$10000, but I think that it would have saved me <$20/year on my policy. For life insurance, I'm currently covered through work, and would have enough to pay for the house in the event of my untimely demise - for now since I'm really young, and don't have any kids, I don't feel that I really need more than this. Over time this will likely change.

MSN had a good article about car insurance not too long ago:http://articles.moneycentral.msn.com/Insurance/InsureYourCar/DumpTheInsuranceOnYourClunker.aspx

Let me know what you think. Did I miss anything obvious? Perhaps you could share a good deer in the headlights story!

Tuesday, June 5, 2007

My Purpose

Topics that hopefully will be covered will be (in no particular order):

- 401(k) / IRAs / Roth IRAs / Retirement

- Budgeting

- Business / Career

- Credit / Credit Cards

- Education

- Giving Back / Charity / Noble Causes / Philanthropy

- Insurance

- Investing / Investment Strategy

- Real Estate / Homebuying

- Stocks / Mutual Funds

- Taxes

- Wills / Estate Planning

If I've missed something important/interesting or you have an idea for a topic, let me know, and I'll try to add it. I'm really looking forward to trying this out and see where it leads!